Relative Strength Index (RSI)

A momentum indicator developed by J. Welles Wilder Jr. (1978) that measures the speed and magnitude of price changes. Traders use RSI to identify whether a stock is overbought or oversold.

RSI Scale

RSI moves between 0 and 100.

RSI Formula (Simple Version)

- RS = Average Gains / Average Losses

- RSI = 100 – [100 / (1 + RS)]

(You don’t usually need to calculate it manually—charting tools do it automatically.)

How to Read RSI

Overbought (RSI > 70)

- An RSI above 70 suggests that the asset may be overbought, indicating a potential price correction.

Oversold (RSI < 30)

- An RSI below 30 suggests the asset may be oversold, indicating a possible rebound.

Example Chart Explanation

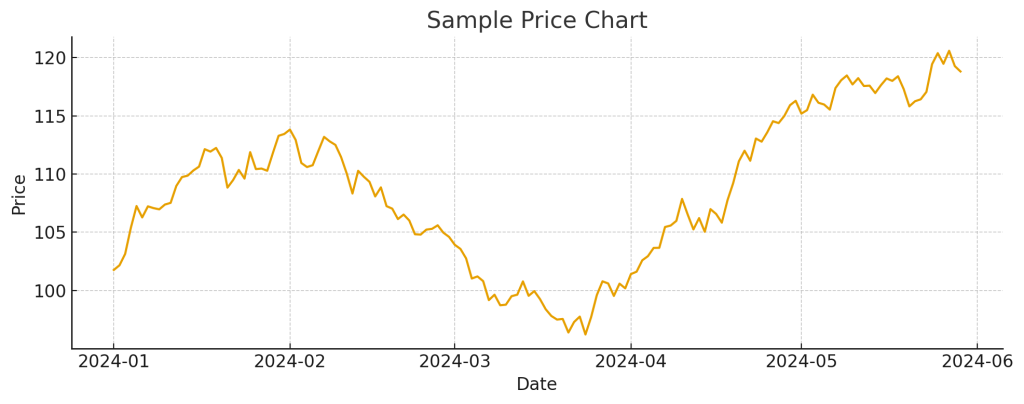

1. Price Chart

(shows the stock’s price movement over time.)

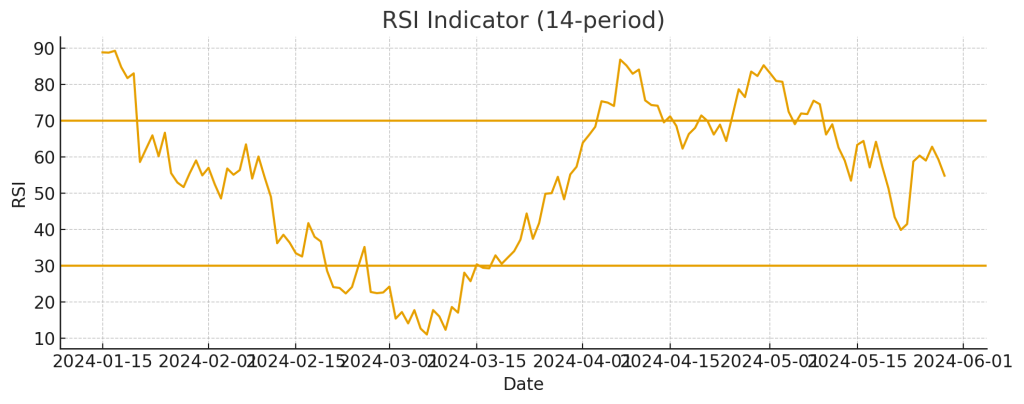

2. RSI Chart

(shows RSI oscillating between 0 and 100 with reference lines at 30 and 70.)

Overbought Example

When RSI rises above 70:

- Momentum is strong but may be overstretched.

- When RSI turns back below 70, the price often slows down or pulls back.

Oversold Example

When RSI falls below 30:

- Indicates strong downside pressure.

- When RSI rises above 30, price often stabilizes or rebounds.

How Traders Use RSI

- Entry Signal (Buy) : RSI crosses above 30 → possible buying opportunity.

- Exit Signal (Sell) : RSI crosses below 70 → possible selling signal.

- Trend Reversals (Divergence) Traders watch for differences between price movement and RSI movement:

- Bullish Divergence:

Price makes lower lows, but RSI makes higher lows.

→ Suggests a potential upward reversal.

→ Buy when RSI crosses above 30. - Bearish Divergence:

Price makes higher highs, but RSI makes lower highs.

→ Suggests a potential downward reversal.

→ Sell when RSI crosses below 70.

- Bullish Divergence:

Limitations

- RSI can stay overbought or oversold for long periods during strong trends.

- It may give false signals in sideways or choppy markets.

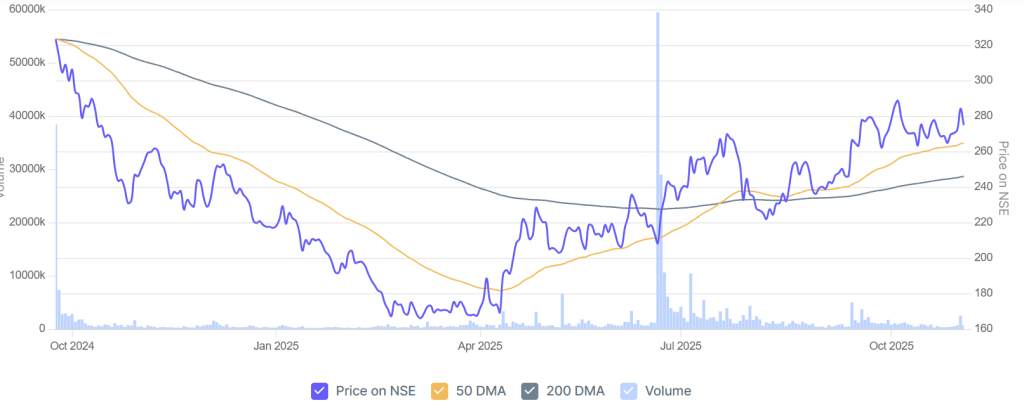

- Works best when combined with price action, moving averages, MACD, or volume confirmation.

Conclusion

The RSI is a simple yet powerful indicator that helps traders understand momentum and identify potential turning points in the market. While it provides helpful signals for entries, exits, and trend reversals, it should not be used alone. Combining RSI with other technical tools and overall market context leads to more reliable and confident trading decisions.