Overview

As of late 2024, the Magnificent 7 — Alphabet (Google), Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla — collectively account for $16 trillion of the S&P 500’s $46 trillion total market capitalization.

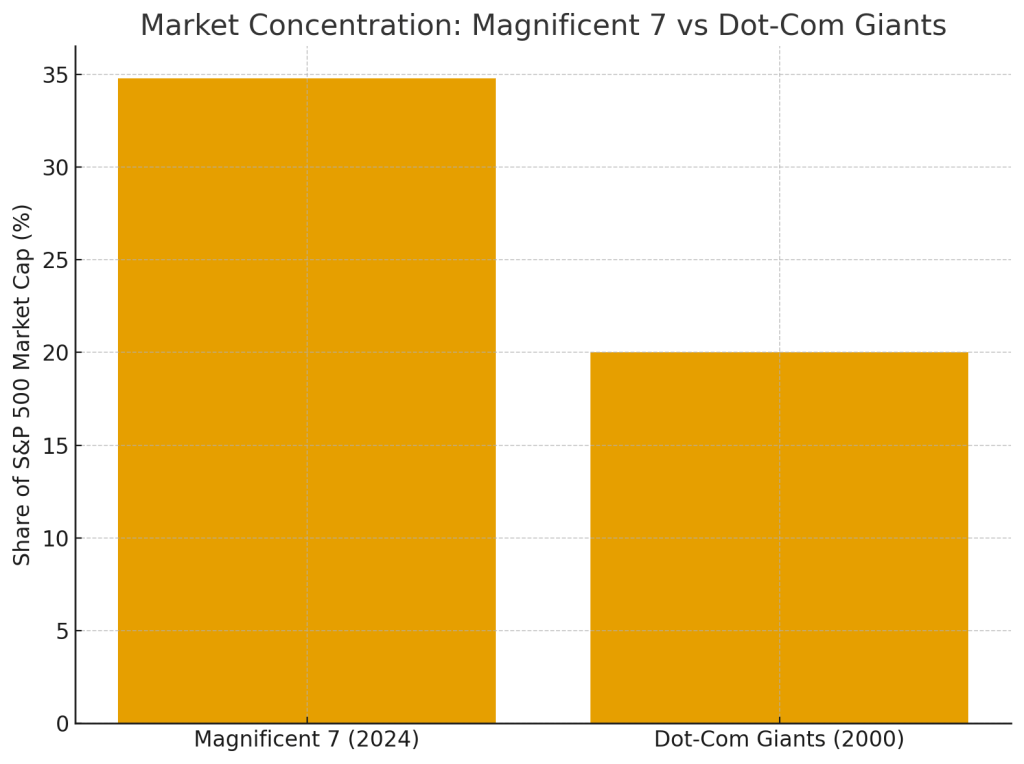

This means these seven companies alone represent 34.8% of the entire index, a massive increase from about 10% in 2014.

For historical context, even during the dot-com bubble of 2000, the largest tech companies never exceeded 20% of the S&P 500. Today’s concentration level is therefore unprecedented.

Over the recent years, the heavy weighting of AI-focused companies has been a major driver of the S&P 500’s growth. This dependence has led many analysts to warn of a potential AI-driven valuation bubble and the risk of a sharp correction if expectations disappoint.

Risk of an AI Bubble Bursting

1. Valuation Risk

AI-focused companies are increasingly trading at valuations that far exceed their underlying fundamentals, echoing patterns seen during the Dot-Com era. For example, Palantir reported $1.18 billion in Q3 2025 revenue and is projecting around $4.40 billion for the full year. Yet its market capitalisation surged to nearly $450 billion, implying a valuation of 115–120× sales—levels typically associated with speculative excess rather than sustainable financial performance. This disconnect between valuation and fundamentals heightens the risk of sharp corrections if anticipated growth fails to materialize.

Many analysts argue that valuations are pricing in hyped future revenues, not current financial performance or realistic near-term applications of AI.

2. Capex vs. Actual Returns

Big Tech is expected to invest $5 trillion on AI-related infrastructure — data centers, chips, model training, and energy facilities.

However, the return profile does not yet justify this scale of investment:

- Only around 5% of businesses currently use AI in full production environments.

- Productivity gains remain slow and uneven.

- Many AI tools still lack clear monetization paths.

This mismatch heightens the risk that expected AI-driven profits may not materialize soon enough to justify the massive capital outlay.

3. Rising Debt Financing

Despite being historically cash-rich, AI-focused tech giants have been taking on large amounts of debt to finance data-center expansion.

For example:

- Oracle reported $124 billion in total obligations (including operating lease liabilities) as of Nov 2025 — up from $89 billion a year earlier.

- Weak earnings combined with rising debt prompted S&P and Moody’s to revise Oracle’s credit outlook to negative.

Analysts see parallels to the dot-com era, when companies overborrowed to fund speculative, unproven technologies. If AI revenues lag, these debt loads could rapidly become unsustainable.

4. “Circular” Investment and Revenue Deals

An emerging concern is the rise of vendor-financed growth loops within the AI ecosystem.

A notable example involves:

- Nvidia, which committed up to $100 billion in staged investments into OpenAI, contingent on the deployment of new AI infrastructure (e.g., gigawatts of data-center capacity).

- OpenAI then uses the capital to purchase Nvidia chips, creating a circular flow of investment → purchase → revenue.

Analysts and regulators have pointed out that this model may artificially inflate demand and revenue, echoing vendor-financing practices seen in earlier speculative periods.

5. Concentration Risk in the S&P 500

With the Magnificent 7 making up nearly one-third of the total S&P 500, the broader market’s stability is increasingly tied to the performance of a small cluster of AI-centric companies.

A synchronized decline in these firms — due to AI monetization delays, regulatory pressure, competitive threats, or earnings disappointments — could:

- Trigger broad market corrections

- Mirror the systemic tech collapse of 2000

- Reduce retirement savings, given heavy household exposure to index funds

- Increase volatility across global equity and credit markets

The S&P 500’s dependence on a single technological narrative — AI dominance — heightens systemic vulnerabilities.

Summary

The rapid rise of AI has created unprecedented concentration within the S&P 500. While AI has transformative potential and the Magnificent 7 possess stronger fundamentals than the tech leaders of 2000, valuation excesses, massive capex commitments, rising debt, circular revenue arrangements, and extreme index concentration have raised concerns about a potential AI bubble.

If AI growth and monetization fall short of current expectations, the resulting correction could echo — or potentially exceed — the impact of the dot-com crash.