Contents:

- Diluted EPS

- Calculation of Diluted EPS

- Diluted EPS using if converted method

- Diluted EPS using Treasury stock method

- Antidilutive security

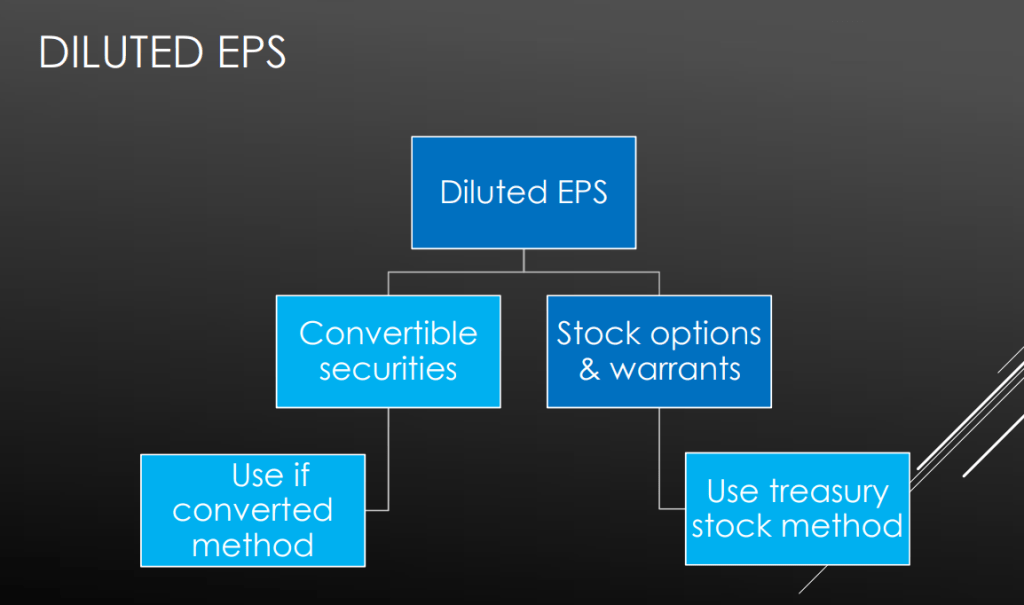

Diluted EPS

Diluted EPS reflects the effect of all the company’s securities whose conversion / exercise would result in a dilution (reduction) of basic EPS.

Dilutive securities includes:

- convertible debt,

- convertible preferred shares,

- warrants,

- Options

- Employee stock options

Calculation of Diluted EPS

Diluted EPS =

(Net income available for common stockholders + Income adjustments due to dilutive financial instruments) / (Weighted average number of shares outstanding + Newly issuable shares due to dilutive financial instruments)

Diluted EPS on Convertible Preference shares using if converted method:

The conversion of preference shares has two effects on diluted EPS formula:

- Increase in denominator of outstanding shares on conversion of preference shares

- Increase in the numerator (Net income available for common stockholders) by dividends on convertible preferred stock.

Let’s understand this with the help of below example:

| Net income | $11,800 |

| Ordinary shares 5,000 shares outstanding | |

| Preferred shares ($2 dividend per share each year) 900 shares outstanding convertible into 2 ordinary shares | |

| Total Preference dividends for the year | $1,800 |

| Basic EPS ($11,800 − $1,800) / 5,000 | $2.00 |

Adjusted net income attributable to ordinary shareholders =

=11,800 + 1,800 ( Preference shares dividend no longer payable on conversion)

= $13,600

Number of shares outstanding on conversion of preference shares = 2000+ 1,800 = 3,800

Diluted EPS = 13,600 / 3,800 = $3.58 per share

Diluted EPS on Stock options using Treasury stock method

An option or warrant gives the holder the right to buy shares at some time in the future at a predetermined price.

Treasury-stock method assumes that proceeds received on exercise of the options is used to buy back shares at the average market price.

To calculate diluted EPS with an option, you need to work out the number of ‘free’ shares that will be issued if the options are exercised, and add that to the weighted average number of shares

Diluted EPS is calculated as if the financial instruments had been exercised and the company had used the proceeds from exercise to repurchase shares of common stock at the average market price of common stock during the period.

The weighted average number of shares outstanding for diluted EPS is thus increased by the number of shares that would be issued upon exercise net of the number of shares that would have been purchased with the proceeds.

We will understand this with the help of below example:

| Net income | $12,000 |

| Ordinary shares shares outstanding | 2,000 |

| Basic EPS ($12,000) / 2,000) | $6 |

| Stock options (200 options with exercise price of $80), 200 shares to be issued on exercise | |

| Average market price per ordinary share during the year | $100 |

Proceeds from exercise of options = 200 x $ 80 = $ 16,000

No. of shares purchased from proceeds of exercise =$ 16,000 / 100 (average market price) =160 shares

Total number of shares outstanding = 2000 + 200 – 160 = 2040 shares

Diluted EPS = 12,000/2,040 shares = $5.88

Antidilutive security

Antidilutive security is a potentially convertible securities whose inclusion in the computation results in an increase in EPS than the basic EPS or a reduction in loss per share.

Under IFRS and US GAAP, antidilutive securities are not included in the calculation of diluted EPS.

Summary

Diluted EPS is an important metric for investors to know how much will be the potential dilution in earning per share if all convertible securities were exercised.

Related articles: