Arbitrage Fund Overview

An arbitrage fund is a type of hybrid mutual fund that seeks to generate returns by exploiting price discrepancies of the same security in different markets (for example, between the cash/spot market and the futures market). They rely on arbitrage opportunities rather than directional bets on stock prices.

Advantages

- Tax efficiency: Classified as equity-oriented mutual funds, so they enjoy lower tax rates compared to fixed deposits and most debt funds.

- Relatively lower risk than equity funds: Returns are not driven by stock price appreciation but by arbitrage opportunities, making them less risky during volatile markets.

- Good for short-term parking: Useful for investors who want to park money for a few months with lower risk and better post-tax returns than liquid/debt funds.

Disadvantages

- Not suitable for long-term wealth creation: Returns are moderate (typically 4–7% p.a.), so they do not generate high capital appreciation like pure equity funds.

- High expense ratio: Arbitrage opportunities require frequent trading, which leads to higher costs compared to debt or liquid funds.

- Returns depend on volatility: If markets are stable with fewer arbitrage opportunities, returns may be lower.

Taxation (as Equity Fund)

- Short-Term Capital Gains (STCG)

- Holding Period: Less than 12 months.

- Tax Rate: 20%.

- Surcharge & Cess: Applicable on top of the 20% tax.

- Long-Term Capital Gains (LTCG)

- Holding Period: More than 12 months.

- Tax Rate: 12.5%.

- Exemption: The first ₹1.25 lakh of LTCG is tax-free annually.

Comparison: Arbitrage Fund vs Equity Fund vs Debt Fund vs FD:

| Feature | Arbitrage Fund | Equity Fund | Debt Fund | Fixed Deposit (FD) |

|---|---|---|---|---|

| Nature of Investment | Hybrid (equity + derivatives) | Pure equity (stocks) | Bonds, govt. securities, corporate debt | Bank deposit |

| Risk Level | Low–Moderate | High | Low–Moderate | Very Low |

| Return Potential | 4–7% (linked to arbitrage opportunities) | High (10–15%+ in long term, but volatile) | 5–8% (depends on interest rate cycle) | 5–7% (fixed depending on tenor) |

| Best Use Case | Short-term parking of funds | Long-term wealth creation | Medium-term income & stability | Safe savings, capital protection |

| Liquidity | High (T+1 or T+2 redemption) | High (but market risk) | High | Medium (premature withdrawal penalty) |

| Taxation – STCG | 20% (if held < 12 months) | 20% (if held < 12 months) | taxed at income slab | Interest taxed at income slab |

| Taxation – LTCG | 12.5% above ₹1.25 lakh (if held > 12 months) | 12.5% above ₹1.25 lakh (if held > 12 months) | 20% with indexation (if held > 3 yrs) | No LTCG; interest always taxed |

| Safety of Capital | Relatively safe (but not guaranteed) | Market dependent | Safer than equity, but credit risk possible | Guaranteed by bank (up to ₹5 lakh insured per depositor) |

| Expense Ratio | High (due to frequent trades) | Moderate | Low–Moderate | None |

| Who Should Invest? | Conservative investors seeking better-than-FD short-term returns | Aggressive investors with long-term horizon | Conservative to moderate investors looking for stable returns | Risk-averse investors wanting fixed guaranteed income |

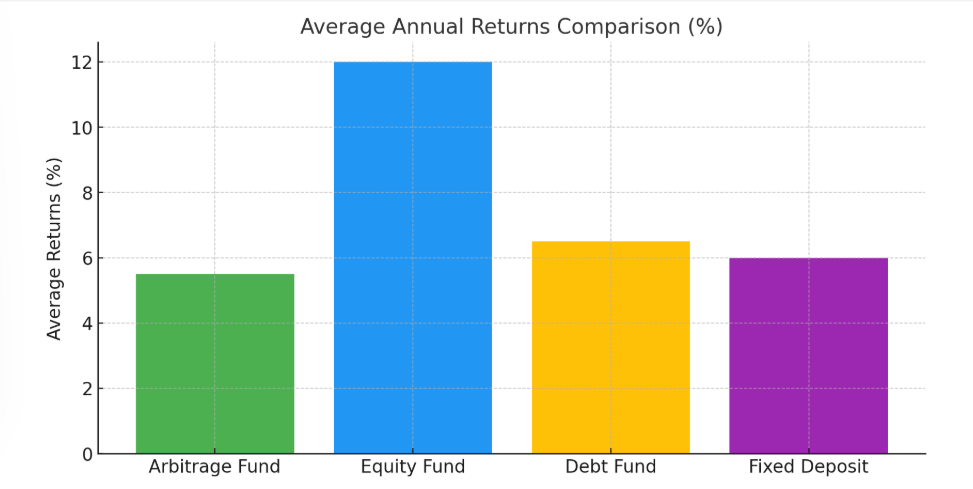

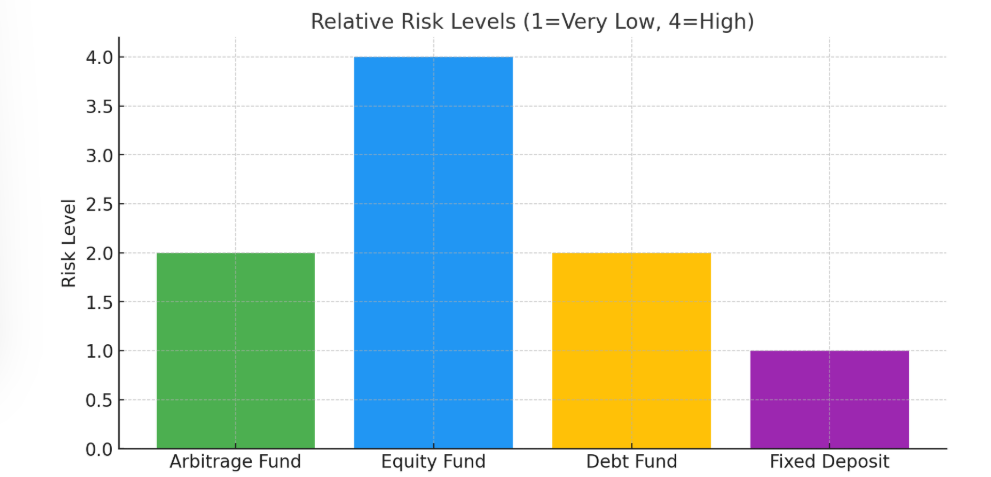

Visual Comparisons

Average Returns Comparison (%)

Relative Risk Levels (1=Very Low, 4=High):

Summary:

- Arbitrage Funds → Good for short-term (low-risk, tax-efficient).

- Equity Funds → Best for long-term wealth creation.

- Debt Funds → Balanced choice for medium-term safety + returns.

- FDs → Safe but least tax-efficient.

In short: Arbitrage funds are low-risk, tax-efficient short-term options but not for long-term growth.